Dallas Tornado Claims – How Recent Texas Legislation Helps Insurance Companies Deny, Delay, and Underpay Claims

According to a quick Google search, the origin of the phrase, “death by a thousand cuts,” is from a now-illegal form of execution in China called lingchi . Lingchi got its start in the tenth century and was in practice in China until it was banned in 1905. During this particularly gruesome form of torture and execution, a convicted criminal was cut many times times until he eventually died a slow death. Each of the cuts, by themselves, were not lethal. It was only the sum total of the non-lethal cuts that served to kill the person. The process was slow and painful, but the end resulting death was certain.

The process of lingchi is a good analogy for the loss of rights, under law, in America. People don’t usually intend to knowingly relinquish all of their rights all at once. However, when those rights are stripped away, one at a time, the sum total of that process, as it is under lingchi, is certain.

Take the well-funded insurance lobbyists attack on homeowner and business-owner rights in Texas. The 2015 Texas legislative session saw an un-precedented sweeping attempt by insurance companies and their lobbyists to make it near impossible for homeowners and business-owners to sue their insurance companies for wrongfully denying, delaying, and under-paying storm damage claims. It was brought under the guise of “protecting insurance companies from frivolous lawsuits that,” beating that old fear-mongering tactic, “will raise your insurance rates if not stopped.” That attack was so broad and sweeping that people wised up and various groups were able to defeat that bill before it passed. This was the full frontal attack on rights and the good folks of Texas recognized it and rose up.

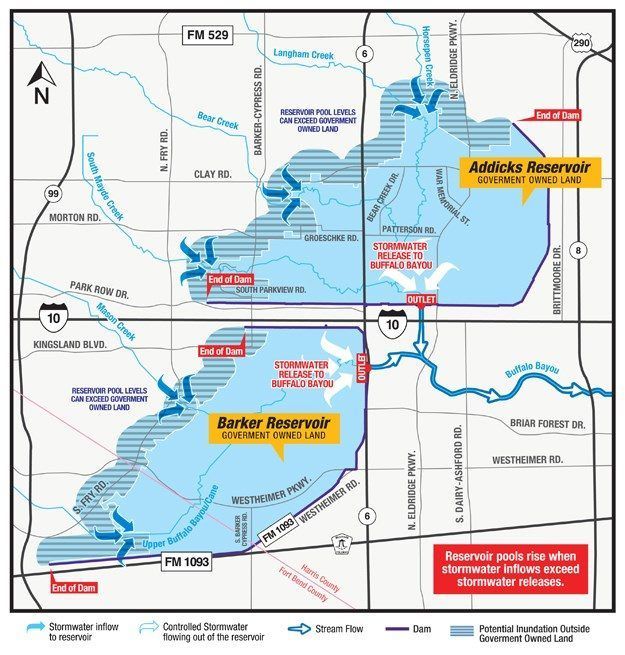

However, the next legislative session in 2017 saw a much more subtle attack on homeowner and business-owner rights. Funded by Texas policyholders’ own insurance premiums, insurance companies and their lobbyists took a non-mortal cut at policyholder rights. They again framed their bill, HB 1774, as an insurance policyholder protection bill. This was not a full frontal attack and many people did not recognize it as such. The bill passed the Texas legislature and went into effect September 1, 2018; right after Hurricane Harvey (to see how each Texas legislator voted on the bill, click here ).

The end result does not have to be the death of policyholder rights in Texas. However, policyholders need to recognize these attacks and stop this death by a thousand cuts in its tracks. As always, we are available here at the firm to discuss the effects these laws continue to have on policyholder rights in Texas.

For an in depth look at the effect of these laws in relation the Dallas tornado, watch the very informative video just posted by the Texas consumer advocacy group, Texas Watch, posted below.

The Storm Counselors at The Corona Law Firm is located in Houston, Texas and proudly serves all of Texas and the United States, including Bexar County, Cameron County, Collin County, Dallas County, Fort Bend County, Harris County, Hidalgo County, Maverick County, Tarrant County, Val Verde County, Oklahoma County, and beyond.